I wish you luck! I'm ready to visit my local office but, I have encountered a different issue:

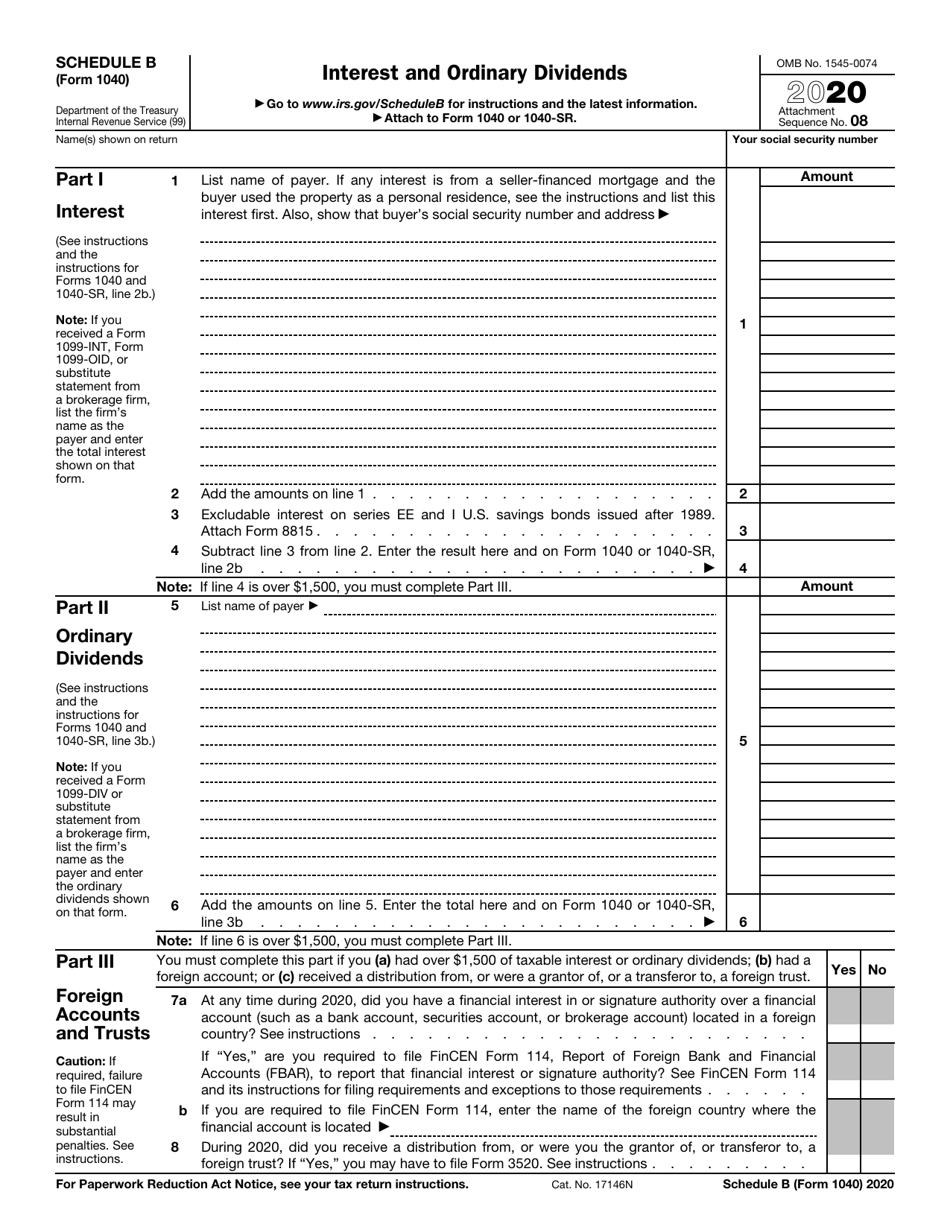

Assuming that all goes well and they reduce your payments, SS can always check back later, when you file your final tax submission, and adjust your Medicare payments accordingly. In theory, that should be acceptable for the SSA-44 review. If married filing jointly, I believe that you need to fill out two SSA-44's to go along with your draft joint income tax submission. For example, in Fidelity, I found sufficient online info under "Documents" "Tax Forms". Since 1099s are unavailable, I worked out draft 2022 tax submission, based upon my year-to-date income and clearly labeled the submission as "DRAFT". I should know in about 3-4 weeks if my appeal / request gets approved. I wanted to interact personally with the agent to reduce the risk of mailing them or leaving in some unsupervised drop-box. She also gave me the name of the SSA agent that would handle my case and review both submissions (together). She made copies, and even stamped "Received 1" on the copies she returned to me.

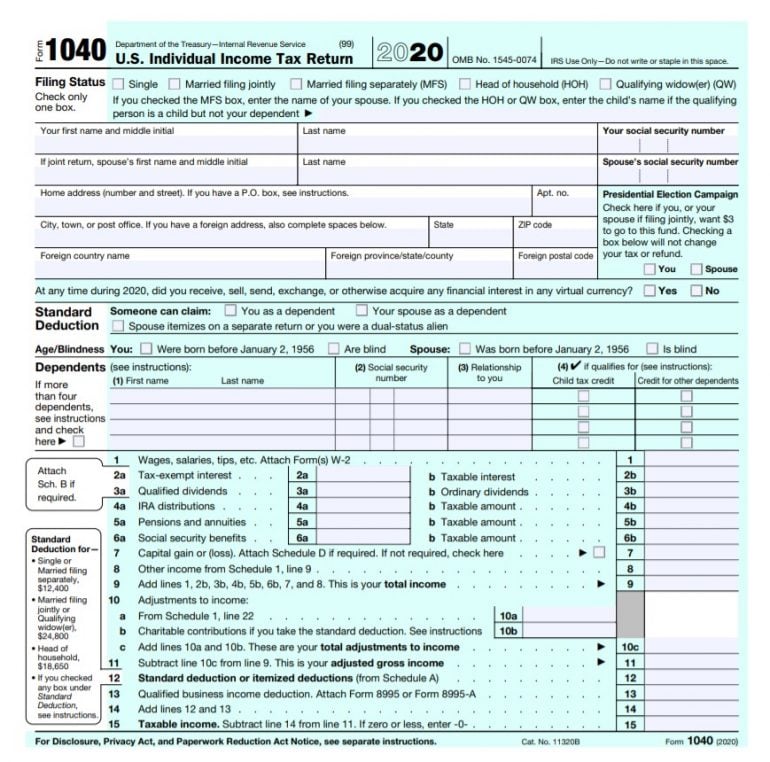

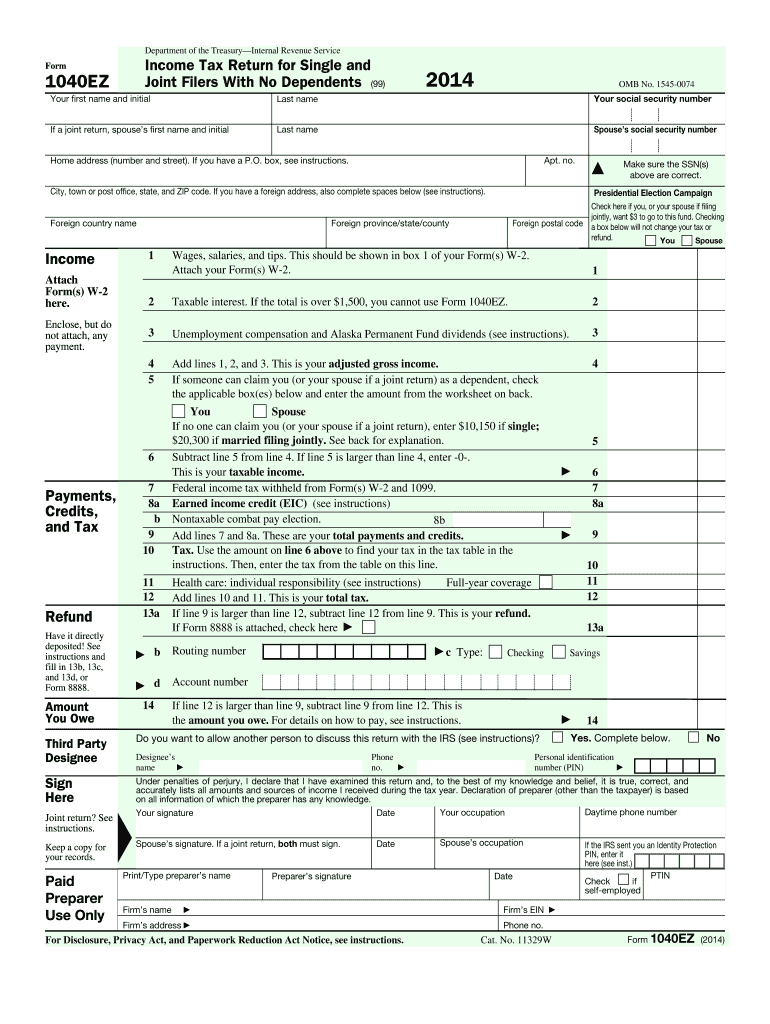

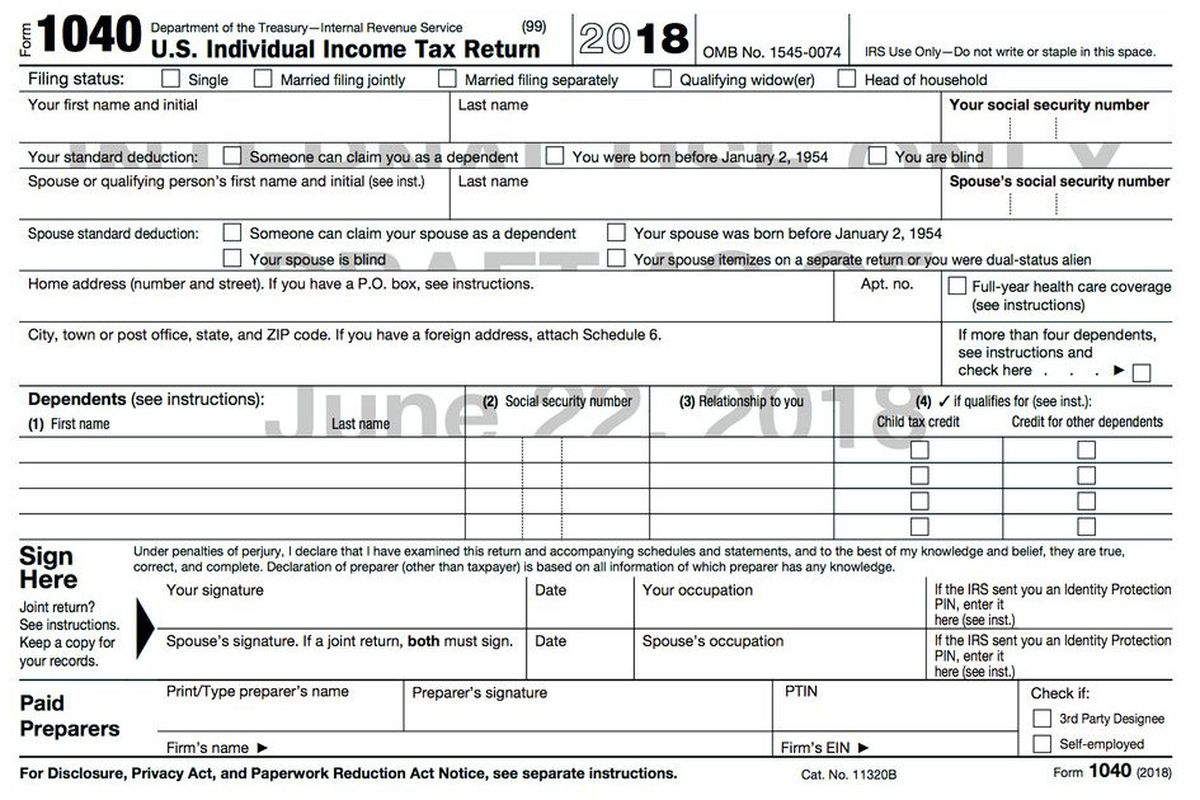

I explained my approach to the agent and she had no issues with the info I provided. I went to the local office in person an waited an hour before I was called to one of the windows. I then filled-out a 2022 1040 Form with my 2023 estimates, and I labelled the Form as "2023 Estimated 1040" (crossing out the 2022 date). I provided a copy of my termination letter and retirement announcement that my employer sent.

You can't submit a single SSA-44 for both both yourself & your spouse. I filled-out two SSA-44 forms that had identical numbers - one for me and one for my spouse (since we file taxes jointly, and my retirement was the single "life event" that impacted IRMAA for both of us). It mentions they will save the info in Step 3 and use it for next year's (2024) IRMAA determination. The instructions indicate that SSA will base your 2023 IRMAA on whatever you enter in Step 2. There was no point in showing preliminary 2022 income since it would not reduce my IRMAA bracket. The real impact (to my income) from my work stoppage does not happen until tax year 2023. I retired in Sept-2022, but my 2022 income (including stock option sales, etc) was still quite large and resulted in the same IRMAA bracket associated with both my 2020 and my 2021 tax returns. Since I filed/submitted mine on 1, I used 2023 estimated AGI for Step 2 and nothing for Step 3. Form SSA-44 is confusing, ambiguous, and contains examples with the wrong year. Same process and same issues & challenges exist as we move into 2023.

0 kommentar(er)

0 kommentar(er)